Tax handling for Combo Bundles

Often retailers like you sell their products by creating virtual combos instead of kitting. By creating a virtual combo on EasyEcom, you can tax the multiple SKUs in your Virtual Combo in three ways by following the below-mentioned process.

Step 1: On the dashboard, click on the “Three dots aka meatball menu”

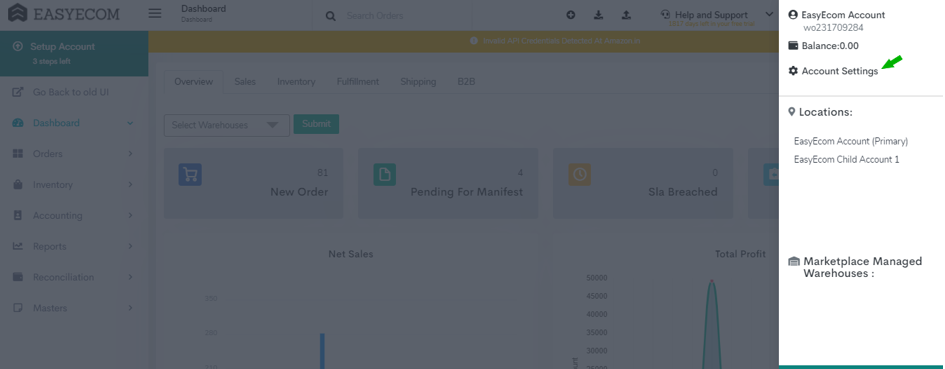

Step 2: Click on the “Account Settings” option

Once you click on the meatball menu you will see the following fly-out menu:

Here click on the “Account Settings” option.

Here click on the “Account Settings” option.

Step 3: Click on “Invoice Settings”

Here click on “Invoice Settings”.

Step 4: Select your “Invoice Formation Acc To” type

Once you click on Invoice Settings you will be navigated to the following page:

Please select your invoice formation type from the drop-down option.

-If you want to apply a Tax Rate for all your child SKU components in the Virtual Combo, select the Individual Component option. -If you want the maximum Tax Rate in your Combo components to apply for all child SKUs select the Maximum Component option. -If you want the minimum Tax Rate in your Combo components to apply for all child SKUs select the minimum Component option.

You can select any taxation method up to your choice.

You have now successfully set a Tax Rate for your Virtual Combo orders.

Related Articles

Creating and Viewing Virtual Combo SKUs

In a virtual combo multiple items are bundled together and sold to a customer. Retailers often sell their product in virtual combos as it helps them in removing their idle stock in boosting sales. Creating combos in EasyEcom will also make it ...Product bundling: Virtual and Physical Bundles

To compete in the market, retailers very often sell their products in bundles to offer customer benefits and retain them. EasyEcom provides two ways to manage the bundling: Virtual bundling and Physical bundling. Let me explain the difference ...How to update Tax for past orders

Updating tax for your past orders is important for tax filing purposes. On EasyEcom, users can easily update the Tax Rules for their past orders also. This means that, if a user has taken a subscription in 2020, s/he can update the Tax Rules for the ...Build your own box feature (Dynamic combo)

Build your own box/Dynamic combo: This feature can be used to build a customized box of products by the user on the fly on your website. EasyEcom facilitates the order and inventory management of a build-your-own box of products or dynamic combo ...Setting up taxation for your B2B and B2C Sales (New Module)

Maintaining accounts for tax purposes is a difficult process for any organization. EasyEcom’s Tax Master makes this process easier for you by defining the tax rules which will be applicable for your product items. Tax can be set in EasyEcom HSN Wise ...