Create Pricing Master Scheme and Customer Group

Software Plan: Startup, Growth & Enterprise

Account Type: Seller Account

Inventory Type: Non Serialize & Serialize

Feature description

The Pricing Master feature empowers you to define custom pricing schemes for your wholesale customers. This allows you to offer personalized and negotiable pricing, fostering stronger relationships with your valued clients. With Pricing Master, businesses can easily create and manage custom pricing rules, leading to increased sales, improved customer loyalty, and overall business growth.

Use Case

1. Ajay has a long-standing wholesale customer, ABC Pvt Ltd. They have been purchasing significant quantities of his products for the past five years.

Using Pricing Master, Ajay can:

- Create a custom pricing tier: Define a special pricing tier specifically for ABC Wholesale.

- Set product-specific discounts: Offer discounts on certain products that are particularly popular with ABC Wholesale.

- Implement volume-based pricing: Provide additional discounts based on the quantity of products purchased by ABC Wholesale.

- Offer exclusive promotions: Offer limited-time promotions or early access to new products to ABC Wholesale as a token of appreciation for their loyalty.

Workflow

Step 1: Go to Masters (main menu) > Pricing Master > Create New Pricing Scheme

Step 2: Mention the List Name. The list name can be used to identify the pricing scheme.

Step 3: Select the Pricing Type.

Pricing Type can be set into 4 types-

- SKU Wise Price List

- Flat Discount on MRP

- Net of Taxes (NOT)

- Net Realization Value (NRV)

1. SKU Wise Price List

SKU-wise price list allows the sellers to use tailored pricing on specific SKUs

Download the Template.

Fill in the details.

Upload the sheet and click on Submit

2. Flat Discount on MRP

Flat Discount on MRP allows sellers to set a discount percentage on their listing or specific SKUs

If you choose "Discount", you can specify the discount percentage, and the discount will apply to the entire listing.

Click on Submit to finalize.

OR

If you select "Upload Sheet", click on "Download Template"

Fill in the details. The discount value will be considered in percentage. This will apply the discount on those specific SKUs which are mentioned in this sheet.

Upload the sheet and click on Submit

3. Net of Taxes (NOT)

In Net of Taxes, the seller can define a Margin Percentage.

If you select "Margin", you can mention the margin percentage and the margin will apply to the whole listing.

Click on Submit to finalize.

If you select "Upload Sheet", click on "Download Template"

Fill in the details. The margin value will be considered in percentage. This will apply the margin on those specific SKUs mentioned in this sheet.

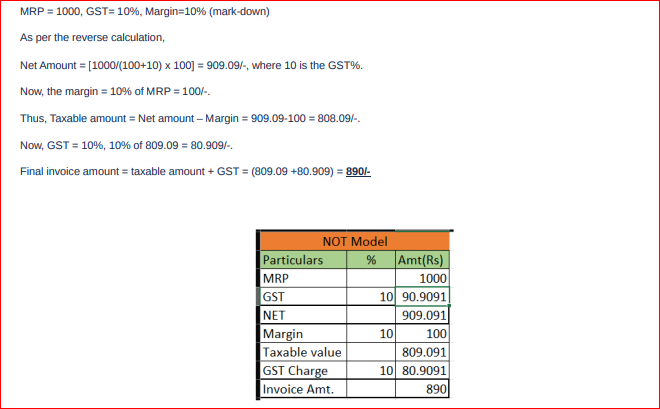

How to calculate Invoice Value based on Net of Taxes (NOT) Pricing Scheme:

4. Net Realization Value (NRV)

In NRV pricing, sellers can set the margin for retailers and stockists. This margin plays a crucial role in determining the revenue generated from the sale of products. By setting the margin, sellers can have better control over the profitability of their products

If you select "Margin", you can mention the margin percentage for retailer as well as the stockist and the margin will apply to the whole listing.

Click on Submit to finalize.

If you select "Upload Sheet", click on "Download Template"

Fill in the details. The margin value will be considered in percentage. This will apply the margin on those specific SKUs mentioned in this sheet.

How to calculate Invoice Value based on Net Realization Value (NRV) Pricing Scheme:

Net Amount = MRP*(1-Retailer Margin %)

GST Factor = (GST+100)/100

PTR (Price to Retailer) = Net Amount/GST Factor

PTS (Price to Super Stockist) = PTR (Price to Retailer) *(1 – Stockist Margin %)

Pricing Scheme Mapping with Customer Group

Step 1: Go to Masters (main menu) > Pricing Master > Create Customer Group

Step 2: Mention Customer Group Name > Choose the Pricing Scheme > Select the B2B Customer/Locations which whom the pricing scheme should be mapped (You may select multiple customers as well) > Click on Submit

A customer group will be created. When creating a B2B order for the same customer using pricing master calculation, the pricing scheme will be automatically applied.

Notes:

1. The new pricing master will not work for international customers

1. The new pricing master will not work for international customers

2. The prices listed on the sheet will be including GST

3. Pricing Master can only be defined/updated in the primary location. However, it will still be viewable in the Child Location

4. Pricing Master can be defined against the SKU. It will not be defined against EAN or Accounting SKU

5. The new pricing master works in the Old & New B2B Module

6. NOT & NRV pricing schemes are only applicable for B2B Customers

7. In case a specific SKU has a discount percentage defined through the UI, and later on, a different discount percentage is defined for that SKU in the sheet, then the sheet's data will override the UI's data.

Related Articles

Create Customers using Customer Master

Software Plan: Starter, Growth & Enterprise Account Type: Seller Account, Aggregator & 3PL Inventory Type: Serialized & Non-Serialized Feature description EasyEcom allows sellers to create wholesale customers for B2B order processing. These customers ...How to Create Orders (B2C, B2B, STN) ?

Three types of orders can be created- 1. Retail Orders (B2C) 2. Business Orders (B2B) 3. Transfer Order (STN) The above-mentioned orders can be created in two ways, either manually or in bulk. How to create retail (B2C) orders? Step 1- Navigate to ...Creating STN order in Easyecom

Software Plan: Growth & Enterprise Account Type: Seller Account Inventory Type: Serialized & Non Serialized Feature description A stock transfer note is created to authorise the movement of inventory from one location to another different location. ...What is a Digital Product ? How to create it?

Software Plan : Starter, Growth & Enterprise Account Type : Seller Account Inventory Type : Serialized & Non-Serialized Feature description A digital product is a good or service that is created, distributed, and consumed entirely in electronic form. ...Customer Level Inventory Blocking

Software Plan : Growth & Enterprise Account Type : Seller Account Inventory Type : Serialised & Non-Serialized Feature description This feature empowers sellers to block specific inventory, reserving it exclusively for valuable B2B clients, specific ...